A large coalition of business groups, trade organizations and state legislators took to the Statehouse steps Tuesday in opposition to a budget proposal put forth by Senate and Assembly Democrats that would raise taxes on millionaires and businesses.

"It's an easy answer to say tax the rich," New Jersey Chamber of Commerce President Tom Bracken said. "But in the long term, this income tax hike hits much more than high-income earners. It also affects everyone in New Jersey in a very direct way. When we increase taxes, we damage our ability to attract and retain businesses. That erodes the tax base and makes our fiscal problems worse."

The budget plan, whose details were first reported by The Star-Ledger on Monday, calls for raising the income tax on those earning more than $1 million annually to 10.75 percent from the current rate of 8.97 percent. The state's corporate business tax would also increase to 10.35 percent from the current 9 percent and BEIP program tax abatements would be put off for a year.

Altogether, Democrats think the proposal can generate $1.3 billion in new revenue and enable the state to fully make next year's scheduled pension payment of $2.25 billion rather than the reduced $681 million pension payment proposed by Gov. Chris Christie.

Christie has previously vetoed versions of the millionaire's tax and has pledged to do so again in the future.

The Legislature has until June 30 to pass a balanced budget.

"The legislative proposals to raise taxes send the wrong message to the business community," New Jersey Business & Industry Association acting President Melanie Willoughby said. "Increasing the tax burden will make it more difficult to create jobs, encourage investment and continue to grow the economy."

On Monday, state Sen. Paul Sarlo (D-Wood-Ridge), chair of the Senate Budget and Appropriations Committee, said that legislative Democrats were "united" behind their budget proposal.

"Our budget plan is balanced (and) at the same time it fully funds the state's obligations," Sarlo said. "It is fiscally responsible, fair and socially compassionate."

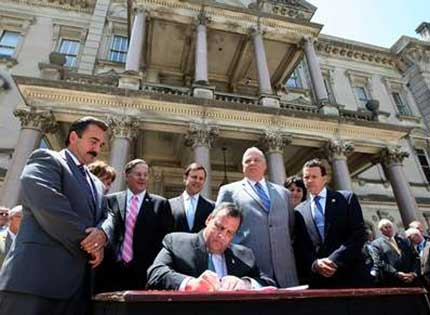

Meanwhile as the two sides dig in on the budget front, Tuesday also played host to a bit of compromise as Christie signed a bipartisan measure extending the 2 percent property tax cap.

"This reform has already showed that it works to protect taxpaying families, who faced year after year of skyrocketing property taxes before we came into office and brought historic reforms and the lowest level of property tax increases in over two decades," Christie said.

Senate President Steve Sweeney (D-West Deptford) added that the law was put in place to give working families a "fair shake in the process and is an example of the kind of positive impact government can have when both sides come together to find common ground."