Murphy joins fellow Democratic governors from New York and Connecticut to officially challenge Trump tax code in federal court.

Within a matter of weeks, New Jersey and at least two neighboring states may be going to court to officially challenge the federal tax-code overhaul that was recently enacted by President Donald Trump. At the heart of the case that's now being organized is a new policy that caps a longstanding federal write-off for state and local taxes.

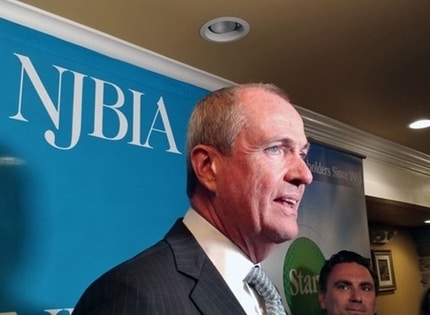

The formation of the multistate legal coalition was announced on Friday by Gov. Phil Murphy, along with Connecticut Gov. Dannel Malloy and New York Gov. Andrew Cuomo. The trio of Democrats are alleging the tax changes that were signed into law late last year are effectively targeting only "blue" or Democratic-leaning states that didn't support Trump in the 2016 president election.

The formation of the multistate legal coalition was announced on Friday by Gov. Phil Murphy, along with Connecticut Gov. Dannel Malloy and New York Gov. Andrew Cuomo. The trio of Democrats are alleging the tax changes that were signed into law late last year are effectively targeting only "blue" or Democratic-leaning states that didn't support Trump in the 2016 president election.

The lawsuit would specifically challenge the tax changes on constitutional grounds in federal court, arguing they violate the equal-protection clause and other provisions. A total of 12 high-tax states are being hit the hardest by the new tax-deduction cap, and the governors said they're now encouraging their colleagues in those other places to join the coalition.

"It's clear it's politically motivated," Murphy said during a conference call that was held with the two other governors. "It's punishment of blue states."

"I'm not going to let that happen," Murphy said.

Fighting on more than one front

The threat of legal action is just one front that Murphy, who took office earlier this month, has opened in the wake of the federal tax-code overhaul, which drew support from only one member of New Jersey's congressional delegation. The new governor has also already embraced a "workaround" proposal that would encourage municipalities to create special charitable funds to help offset the loss of a full federal deduction for state and local taxes that are known as SALT. Murphy also signaled on Friday that he's now taking a close look at another tax proposal, one that was put forward earlier this month by Cuomo that would involve converting the state income tax into a corporate payroll tax, again to help offset the new cap on the SALT write-off.

"Our creative juices are flowing," Murphy said

After the three-state legal coalition was announced by the governors, it drew praise from the leader of a key New Jersey business group that has been an outspoken critic of the tax-code revisions. But a spokeswoman for U.S. Rep. Tom MacArthur (R-3), the lone Republican from New Jersey to vote for the tax bill, accused Murphy of acting with only partisan intentions.

The federal tax changes signed into law by Trump just before Christmas slightly lowered individual income-tax rates and, among other changes, significantly cut the federal tax burden for corporations and those with large estates. To help pay for those cuts, the tax-code overhaul also made several changes to rules related to federal tax exemptions and deductions.

Modest tax relief

While several analyses of the changes indicate many New Jersey residents will see some modest tax relief as a result of the overhaul, many others who itemize their deductions - an estimated 40 percent of the state's taxpayers - may see a tax increase, largely due to a new $10,000 cap on the SALT deduction. That's because the average annual property tax bill in New Jersey costs more than $8,500, and the bills can run much higher in many parts of North Jersey. In fact, average property taxes top $10,000 in the counties of Morris, $10,039; Union, $10,821; Bergen, $11,311; and Essex, $11,550. Meanwhile, the state's per-capital state income-tax burden totals nearly $1,500.

Murphy had previously said he was exploring legal options in the wake of the tax legislation's adoption. Just last week, he also announced his administration was joining a lawsuit against the Trump administration's decision to end DACA that was launched last year by New York and 14 other states.

During the conference call with reporters that was held on Friday on challenging the federal-tax legislation, Murphy and the other governors made the case that not every state is getting hit as hard as their home states by the new cap on the SALT deduction. They also argued, citing the writings of Abraham Lincoln at one point, that the tax changes amount to double taxation, and go right to the heart of the idea of federalism and "shared power."

"Legally, we believe there is a very strong argument that it's unconstitutional," said Cuomo, who served as the attorney general in New York before being elected governor in 2010.

Malloy said he is anxious to begin the discovery process in the proposed lawsuit to dig into the true motivation of those who crafted the tax legislation and made sure it got through the Congress.

"There undoubtedly will be some very interesting discovery," Malloy said.

Murphy said he expects the lawsuit to be filed in federal court in "a couple of weeks." While some legal scholars have already shot down the idea that the states could somehow challenge the federal government's long-held power to levy income taxes, Murphy said the effort is not just for show or symbolism.

"We believe there's a very strong case," he said.

Reached after the announcement was made on Friday, Tom Bracken, the president and chief executive of the New Jersey Chamber of Commerce, praised Murphy for "standing up for the state." Bracken's organization has previously criticized the federal tax changes, which are expected to take a toll on the state's housing market and broader economy.

"If it works, it works, and if it doesn't, it doesn't, but I still applaud him for the effort," Bracken said.

But Camille Gallo, a spokeswoman for MacArthur, accused Murphy of "wasting the state's resources and time to continue his dishonest campaign against the new tax law."

"The truth is the new law is absolutely a win for a New Jerseyans," Gallo said, pointing to things like the newly lowered income-tax rates and a significant increase of the standard deduction.

"If Governor Murphy really wants to help New Jerseyans he would work to lower taxes in the state instead of playing partisan games," she said.