New Jersey should earmark at least $500 million of the state’s federal windfall to lessen the pain of struggling businesses and energize the state’s economic recovery, the state chamber of commerce urged lawmakers Wednesday.

Congress on Wednesday passed President Joe Biden’s $1.9 trillion stimulus package, which includes $350 billion to state and local governments. With an estimated $6.3 billion in federal aid likely headed to New Jersey’s state coffers and billions of dollars in unspent borrowing in Gov. Phil Murphy’s proposed budget, there’s no shortage of ideas for spending the bounty.

Murphy said at a coronavirus briefing in Trenton that a comprehensive plan for the massive stimulus aid will come in time, but that the needs are many.

“Vaccination support and all the monies that go with that. Keeping front line workers employed and delivering services. Unemployment insurance benefits, the expansion of Medicaid that we’ve seen over the past year, rental assistance, landlord assistance, all the utilities payments that are in arrearages — I think now the estimate is $700 million, a devastating reality for small businesses, restaurants, bars. More help for child care. I could go on,” he said. “There’s lots of areas where we could put those resources to good use.”

At an Assembly budget committee hearing on the governor’s proposed budget, advocates called for more funding for New Jersey’s direct service providers, cancer research, clean energy and affordable housing, and for the state to bring relief to undocumented immigrants excluded from unemployment benefits and stimulus measures.

The $44.8 billion budget Murphy unveiled last month includes tax rebates for 764,000 households, a $6.4 billion payment to the public worker pension fund, $9.3 billion in school aid, $50 million to launch a tuition-free four-year college initiative and expanded earned income and child and dependent care tax credits.

Much of the increased spending is fueled by $4.3 billion in bond proceeds the state borrowed to balance the current budget but that proved unnecessary. The borrowing will allow the state to amass an estimated $7.7 billion surplus by the end of this fiscal year in June, which Murphy proposes to spend down to $3.5 billion next year.

The New Jersey Chamber of Commerce urged lawmakers to slash the corporation business tax rate, set aside at least $500 million for grants and loans to New Jersey businesses and even more to replenish the unemployment trust fund. Employers face an increase in payroll taxes this July to raise money for the trust fund, drained by more than 2 million pandemic-era claims.

Another business group, the New Jersey Business and Industry Association, has estimated nearly four in ten small businesses have closed their doors and for those that remain, revenue has plummeted.

They need more robust support, the chamber’s Michael Egenton said.

“Before the pandemic, New Jersey was struggling with competitiveness and affordability. The last year has only exacerbated that. With the ‘windfall’ that the state will realize, this is a great opportunity to re-position New Jersey as an attractive state to do business,” he said.

Nearly 55,000 small businesses have received a total of $224 million in grants and loans from the state, Egenton said, adding that is just 6% of the more than 800,000 small businesses operating in the Garden State.

“While we are grateful for the funding that has already been provided, we know that there is still clearly a demonstrated need for more assistance if our economy is to survive and bounce back,” Egenton said. “Almost every program that the (Economic Development Authority) provided was oversubscribed in record time.”

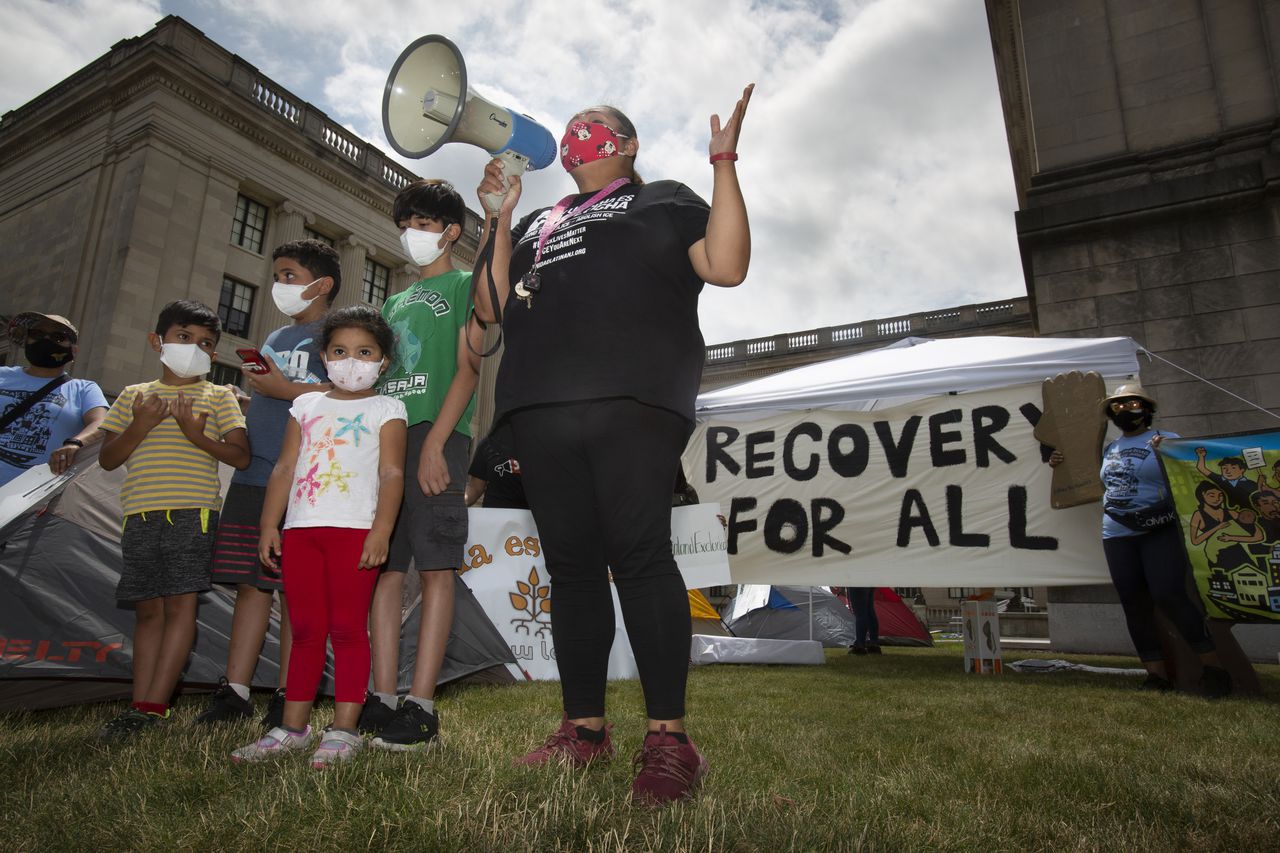

But a half million undocumented immigrants are excluded from federal stimulus payments and pandemic unemployment benefits altogether “despite paying $600 million in state and local taxes, $1.2 billion in annual federal taxes and, over the past 10 years, over $1 billion to the state’s unemployment coffers,” said Nedia Morsy an organizer for the advocacy group Make the Road New Jersey.

Because undocumented immigrants are struggling to find relief — more than one in four work in industries that were hardest hit by the pandemic — thousands have reported being unable to pay for basic necessities like food and utilities, according to a September Make the Road study.

More than 80% of respondents said they lost their jobs or lost hours, and more than three-quarters said they were worried about paying the light bill or buying food and medicine. One in four residents said they were behind by at least four months on rent or mortgage payments, the study found.

Dena Mottola Jaborska, associate director of New Jersey Citizen Action, called the lack of cash assistance in Murphy’s proposed budget a “glaring deficiency” and one she hoped the Legislature would correct.

“It would be shameful for New Jersey to continue to pass over the needs of 475,000 immigrant workers, families struggling to keep a roof over their heads and food on their table, many of them essential workers in this pandemic,” she said. “This labor has kept us comfortable at home while they have continued to work at restaurants, warehouses, manufacturing plants, health care facilities and more, and putting themselves at risk of contracting COVID.”

Morsy called on the lawmakers to set aside funds to create a pandemic relief fund for the undocumented, who were ineligible for unemployment benefits, federal stimulus checks and most safety net programs.

That relief, she said, should include $600 weekly payments to unemployed workers who can’t collect unemployment benefits and “stimulus-like” payments for New Jerseyans without immigration status.

“It is unconscionable to think that the state might issue another stimulus payment this summer to the same families already supported so many times over, while once against passing over these immigrant working families,” Mattola Jaborska said.

“And with the improved revenue outlook and federal COVID relief funding coming soon, no one can rightfully suggest that we do not have the funding we need to provide this relief.”