As they look to do better from latest federal aid package, the big question for small business owners concerns access to working capital

The adoption of a new federal aid package with billions of dollars in new funding for small businesses comes just as officials in New Jersey are beginning to give more attention to what the state’s recovery from the coronavirus pandemic will look like.

The new aid package signed into law by President Donald Trump includes at least $250 billion for small businesses, as well as significant funding for hospitals and testing initiatives that are considered crucial for addressing both public health and economic recovery goals.

But its enactment comes even as major questions remain about how an earlier round of federal funding was distributed to businesses. They include whether some of the hardest-hit states, including New Jersey, were shorted at the expense of others. Meanwhile, New Jersey government itself is still reeling and in need of direct aid from the federal government, according to Gov. Phil Murphy.

How well New Jersey and its businesses can move beyond the survival phase to the recovery phase is among the most important issues facing the state and too many big questions remain unanswered — like what working capital will sustain businesses as they try to rebound — according to Tom Bracken, president of the New Jersey Chamber of Commerce.

But, getting the recovery effort right also offers a big opportunity for New Jersey to show its stuff at the most important time, Bracken said in an interview with NJ Spotlight.

Crafting New Jersey’s economic recovery

“If we execute our recovery in a way that gets us up and running, and accommodates all of the issues, and is perceived well and gets people whole, quickly, the way we craft our recovery could give us a big competitive advantage,” Bracken said. “I think that can be a big selling point for us going forward…,” he said.

New Jersey has been among the states hit hardest by the pandemic, trailing only New York when it comes to the total number of COVID-19 infections and fatalities.

But there have been some glimmers of hope even as economic activity has largely been shut down for weeks by the strict social-distancing measures Murphy enacted last month to help slow the spread of the disease.

Murphy, a first-term Democrat, has pointed in recent media briefings to data that suggests the curve of infections has begun to flatten in New Jersey. That’s a promising development, if it holds, both for the state’s public health effort and for its economic outlook.

A new saliva test unveiled by Rutgers University earlier this month is also being viewed as another important development since it could help the state meet widespread testing goals that are considered key to the state’s economic recovery.

Governor urges caution

Still, Murphy has also been urging continued caution as new cases and deaths are still occurring, even as many are anxious for a return to normal.

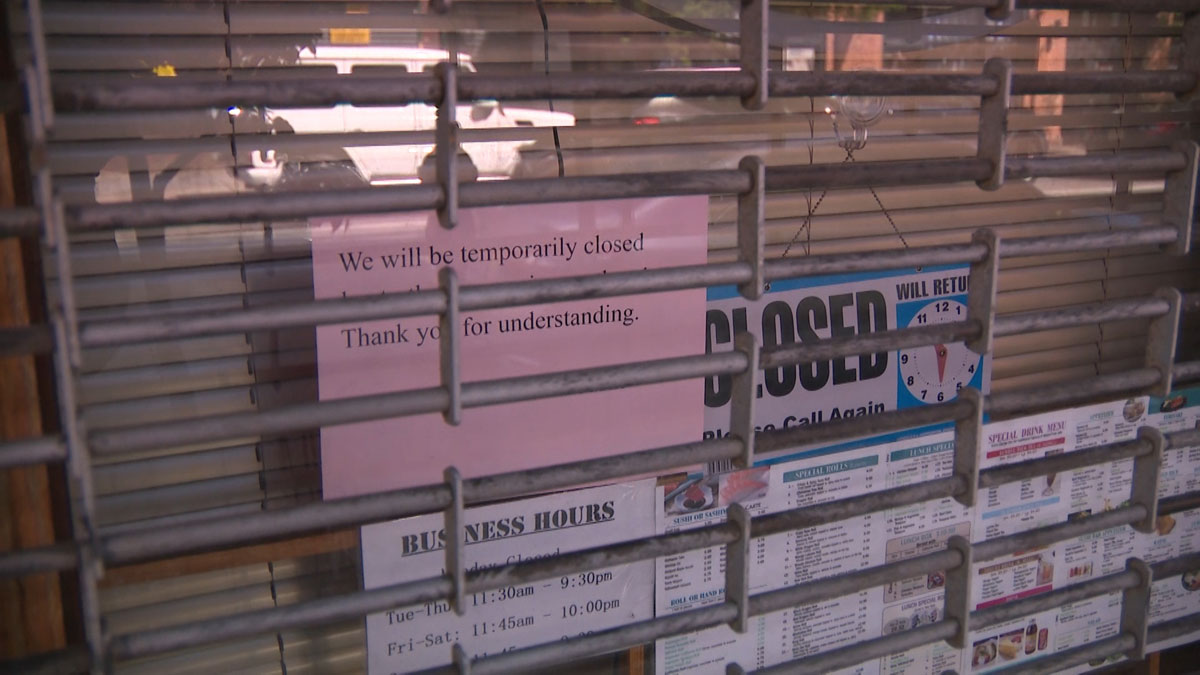

Meanwhile, many New Jersey small businesses are also still struggling to get aid from the federal government’s Main Street support initiative known as the “Paycheck Protection Program,” or PPP. While the problem was caused in part by the overall funding not matching up to demand, there also appears to have been an uneven distribution of aid from the $2 trillion stimulus package that Trump signed into law last month.

Research released by the nonpartisan Urban Institute lists New Jersey among the states where the share of federal funding provided to businesses has not kept pace with the rate of new unemployment claims in those states. In New Jersey, the filing of new claims has risen dramatically and set records in recent weeks.

Asked about those concerns, Bracken said there seems to be a “disconnect” in how the first round of funding was provided. The new round of PPP funding makes at least another $250 billion available for business loans.

“We have to keep fighting for more,” he said.

Bracken also suggested that while the new cash infusion will be a big help, it continues to fall below what’s needed to sustain all the businesses that are fighting for their survival right now. Those needs may total $1 trillion across the country, he said.

“Everything is a help,” he said. “But it’s far from what the demand is.”

Tax revenues take a beating

And then there are the concerns being raised by Murphy and the leaders of other states that are seeing their tax revenues hammered by the pandemic even as they are taking on unexpected costs to respond to the health crisis.

Murphy has repeatedly called on Congress to provide “direct cash assistance” to the states, and he has also voiced frustration with U.S. Senate Majority Leader Mitch McConnell’s recent suggestion that states should be allowed to go “bankrupt,” something they cannot do under federal law.

“It’s very important that, as we go forward, both (the state and the business community) have a rebirth in their health,” Bracken said.

Murphy has been working with the governors of several neighboring states to establish a regional approach to resuming economic activity in a way that balances the health concerns of the still-unfolding pandemic with the broader economic-recovery goals. More information about New Jersey’s planning efforts could be released on Monday, according to the governor.

State legislative leaders have also been eager to play a role in the planning efforts and have organized their own working groups in recent days.

A key concern that Bracken wants these planning efforts to focus on is how to meet the working-capital needs of recovering businesses that will be challenged with things like meeting payroll once some of the funding from the initial support programs runs dry. Like the federal government’s efforts, some of the new state programs that have been set up in response to the pandemic have also seen incredible demand.

“We need to do something that’s New Jersey-centric,” Bracken said. “Having a source of liquidity that could fund programs that fit the needs of the New Jersey marketplace.”

But he also sees the recovery task as an opportunity for the state to improve its reputation by pulling off a successful and well-balanced recovery.