Incentives are imperative to our state’s economy and in making New Jersey competitive. We appreciate the Legislature’s willingness to extend the current programs (A-5343) until we can find a more viable option for a longer-term solution.

Recognizing that the current programs took approximately 18 months to effectuate, we cannot create a new, more effective, functioning program within the next two weeks. Nor can we allow for the current ones to expire.

A state that lets its economic growth incentives lapse signals that it is “out of business.”

Senate President Steve Sweeney said the Legislature will send Gov. Phil Murphy a budget without the millionaire’s tax increase that the governor is pursuing; he said reforming pension and health care benefits for public employees is vital to solving the state’s fiscal problems; and he said Gov. Murphy should extend the state’s soon-to-expire corporate tax incentive program until a revised incentive program is adopted.

Business and state government leaders, including Lt. Gov. Sheila Oliver, filled the galleries and the outdoor pavilions of the New Jersey State Museum in Trenton on June 6 for the New Jersey Chamber of Commerce's 22nd Annual Open House.

The museum - across the street from our Trenton offices - provided air-conditioned space indoors and river-view space outdoors for mingling and dining. As always, there was great food and drink, and ample networking opportunities.

- 2019-05-28

- ROI-NJ Op-Ed

Policymakers, including the Legislature and the Governor’s Office, all agree — tax incentives are an important and effective tool in New Jersey’s economic development toolkit.

In fact, everyone agrees that the absence of an effective program leaves New Jersey ill-equipped to compete regionally to attract and retain businesses, because of the high cost of doing business in the state. Tax incentives are necessary to help level the playing field.

The New Jersey Chamber of Commerce is saddened to announce that Joseph Vales, a prominent New Jersey attorney, community leader and member of the NJ Chamber’s Board of Directors passed away on May 3 from complications related to a stroke. He was 60.

- 2019-03-27

- NJ Spotlight

Long-terms goals include making college more affordable, keeping talent in New Jersey, and giving students a stronger voice

For the first time in more than 13 years, New Jersey has a plan for improving higher education in the state. It includes enhancing college affordability, creating work opportunities, ensuring safe and supportive campuses, and prioritizing student voices in decision-making processes. And university professors and faculty members are prepared to strike to see these goals reached.

We welcome the creation of the state’s task force on New Jersey’s Plan for Higher Education, outlined today by Gov. Phil Murphy and Secretary of Higher Education Zakiya Smith Ellis. The task force’s objectives include something the New Jersey Chamber of Commerce has long been seeking – a stronger partnership between New Jersey’s business community and our state’s institutions for higher learning.

- 2019-03-23

- NJ Advance Media for NJ.com

New Jersey Democrats’ deal last summer to raise taxes on income over $5 million provided only the briefest of reprieves from the debate over the millionaires tax in the Garden State.

Now, Gov. Phil Murphy’s proposed budget for next fiscal year has thrust the millionaires tax back into the spotlight with his plans to raise $447 million in new tax revenue from increased taxes on the rich.

- 2019-03-20

- ROIO-NJ

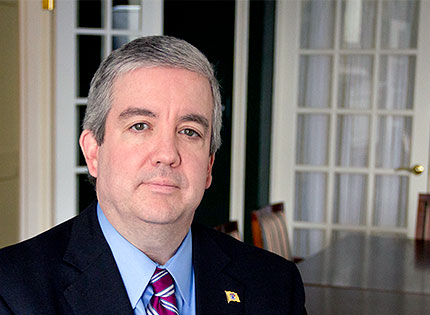

Michael Egenton has been around the Trenton block for 30 years — 25 of which have been spent at the New Jersey Chamber of Commerce.

Over the years, he’s learned a few time-honored truths: Don’t think you’re going to get everything you want (you aren’t), never provide misleading information (it will damage your reputation) and don’t push too far (it could cost you access).

During a recent sit-down with Egenton, ROI-NJ asked him to compare and contrast governors of the past — and how he thinks current Gov. Phil Murphy is doing.

- 2019-03-20

New Jersey Chamber of Commerce Executive Vice President Michael Egenton's Statement on Proposed State Budget Following His Testimony at the Assembly Budget Committee

One thing we know to be true is that in order for our economy to flourish, we have to be competitive. How do we stay competitive? With a smarter, more strategic and practical approach.