- 2019-03-23

- NJ Advance Media for NJ.com

New Jersey Democrats’ deal last summer to raise taxes on income over $5 million provided only the briefest of reprieves from the debate over the millionaires tax in the Garden State.

Now, Gov. Phil Murphy’s proposed budget for next fiscal year has thrust the millionaires tax back into the spotlight with his plans to raise $447 million in new tax revenue from increased taxes on the rich.

- 2019-03-20

- ROIO-NJ

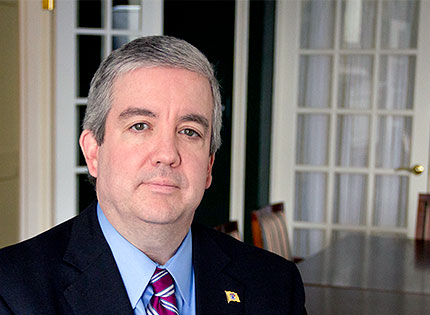

Michael Egenton has been around the Trenton block for 30 years — 25 of which have been spent at the New Jersey Chamber of Commerce.

Over the years, he’s learned a few time-honored truths: Don’t think you’re going to get everything you want (you aren’t), never provide misleading information (it will damage your reputation) and don’t push too far (it could cost you access).

During a recent sit-down with Egenton, ROI-NJ asked him to compare and contrast governors of the past — and how he thinks current Gov. Phil Murphy is doing.

- 2019-03-01

- ROI-NJ

Everyone knows the Walk to Washington train trip is the ultimate networking opportunity in New Jersey.

Where else can you get more than 1,000 political and business leaders in all sectors coming together for 36 hours?

Those on this year’s trip got a little bit more.

- 2019-02-13

- ROI-NJ Op-Ed

The partisan winds in Trenton have been blowing hot and heavy since the state comptroller issued a report criticizing the Economic Development Authority’s tax credit and economic incentive programs, and Gov. Phil Murphy intensified the storm when he took the EDA to task in his State of the State address.

- 2019-01-25

- NJBIZ

The state Legislature’s top two Democrats jointly unveiled a planned Feb. 11 legislative hearing into the effectiveness of billions of dollars awarded by the state Economic Development Authority, hours after Gov. Phil Murphy announced a similarly-goaled task force to examine many of the same incentives.

An audit by the Office of the State Comptroller released Jan. 9 found that the EDA had little oversight and accountability regarding $11 billion in tax credits it awarded between 2005 and 2017, making it difficult to determine if companies actually delivered on their promised jobs and economic activity.

- 2019-01-17

- NJ Spotlight

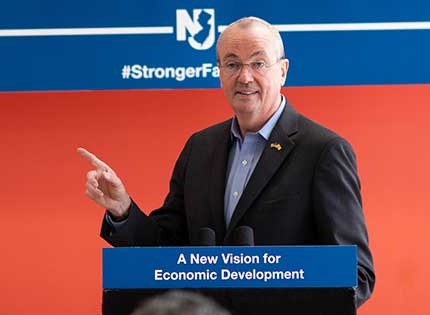

Against a backdrop of tepid support from Democratic legislative leaders, Murphy makes case for overhauling New Jersey’s big tax breaks

A day after using the State of the State address to urge lawmakers to work with him on a major overhaul of New Jersey’s tax-incentive programs, Gov. Phil Murphy put on his salesman hat and went on the road to pitch the specifics of his vision for how the state should use tax breaks to grow the economy.

- 2019-01-16

- NJ Spotlight

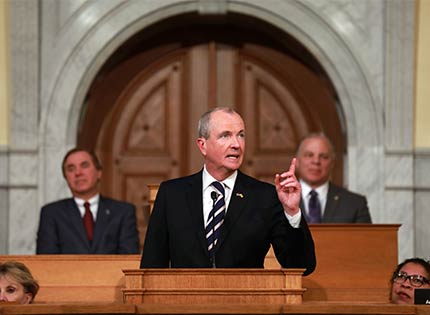

During a rebuttal news conference, GOP lawmakers push back on the governor’s anti-Christie theme

Gov. Phil Murphy used the annual State of the State address yesterday to both showcase the new direction New Jersey is headed after eight years under Republican Chris Christie and highlight an urgent need to remake one of the state’s signature economic-development policies.

- 2019-01-16

- ROI-NJ

The business community can breathe a sigh of relief. Maybe.

Gov. Phil Murphy, in a phone interview with ROI-NJ on Wednesday to discuss his new tax incentive proposals, said he has no plans to increase taxes on businesses as part of next year’s budget.

- 2019-01-15

- ROI-NJ

State chamber’s Bracken on attack on EDA: 'It isn’t even our biggest problem'

Gov. Phil Murphy’s first State of the State address was met with skepticism from the state’s business community.

- 2019-01-10

- NJ Spotlight Op-Ed

The governor wants a fairer economy in New Jersey but companies are bearing the heaviest burden of delivering it. Taxes and mandates have made the state unaffordable and uncompetitive

New Jersey received a serious wake-up call last week.

Celgene, the Summit-based biosciences company, announced it has reached an agreement to be acquired by New York-based Bristol-Myers Squibb in a blockbuster deal worth $74 billion.