- 2018-03-13

- CBS2 News

After he made a lot of pricey promises on the campaign trail, many people wondered how New Jersey Gov. Phil Murphy would pay for it all. On Tuesday, he announced his budget plan. CBS2's Meg Baker interviews NJ Chamber President Tom Bracken.

Laura Hahn has joined the New Jersey Chamber of Commerce as director of government relations, where she will advocate on behalf of the business community, primarily in economic development, taxation, and health care. Laura reports to Michael Egenton, executive vice president of government relations with the Chamber.

- 2018-03-11

- NJ Advance Media for NJ.com

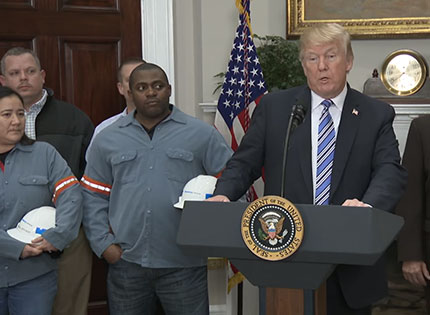

President Donald Trump's tariffs on imported steel and aluminum would cost New Jersey businesses an extra $477 million -- more than all but seven other states -- according to a new study.

The report by the Tax Foundation, a conservative research group, shows that Trump's action would add a new burden to the state's business community, already concerned about the impacts of the Republican tax plan that shrunk a key tax break for the Garden State.

The tariffs would cost businesses $9 billion, with $5.7 billion, or 63 percent, falling on businesses in just 10 states, including New Jersey, the report said.

- 2018-03-11

- Observer

New Jersey lawmakers are moving to enact a statewide sick leave law now that Democrat Phil Murphy is in the governor’s office.

The Assembly Labor Committee is scheduled to consider a bill (A1827) on Monday that would require companies to provide their workers with earned sick leave. Under the bill, employees would accrue one hour of sick time for every 30 hours worked, and workers could earn between 40 and 72 hours of sick time depending on the size of their employer. Employees would have to work 90 days before they could use their sick time.

- 2018-03-08

- NJ Advance Media for NJ.com

President Donald Trump has threatened to shut down the government rather than fund the Gateway Tunnel project, according to a published report.

Trump said he would veto legislation funding the government through Sept. 30 if it included money for a new tunnel linking New Jersey and Manhattan, according to Politico, which cited multiple sources.

- 2018-03-08

- NJ.com

It's not Amazon's coveted HQ2, but a project under way in West Deptford Township is expected to be good news for job seekers in the region.

Amazon is constructing a 650,000-ssquare-foot fulfillment center on Mantua Grove Road, according to company spokeswoman Rachael Lighty.

When operations begin, the center will employ 1,000 full-time workers, she said.

- 2018-03-08

- Observer

The head of the New Jersey Chamber of Commerce had a warning for state leaders Wednesday—the more you talk about tax increases, the less chance you have of convincing Amazon to locate its new headquarters in the Garden State.

Tom Bracken, CEO and president of the New Jersey Chamber of Commerce, told ROI-NJ that Gov. Phil Murphy’s continued support for a millionaires tax and Senate President Steve Sweeney’s call for a surcharge on businesses earning more than $1 million is likely to drive away businesses and make the state less competitive.

- 2018-03-07

- ROI-NJ

Between Gov. Phil Murphy pursuing a millionaires tax and Senate President Stephen Sweeney’s planned 3 percent tax on corporations, the state has taken a U-turn from the days of a $7 billion tax incentive to lure one of the largest companies in the country to New Jersey.

Tom Bracken, CEO and president of the New Jersey Chamber of Commerce, said this new focus is harming the state’s competitive ability.

- 2018-03-01

The N.J. Chamber Train to D.C. carried nearly 1,000 riders

Guests at the Dinner included Gov. Murphy, both U.S. Senators, 7 House Members, 50 Legislators, 40 News Reporters, and one Cardinal

The 81st Annual Walk to Washington and Congressional Dinner, on March 1 and 2, 2018, was one of the biggest in a decade with nearly 1,000 of New Jersey's business and government leaders on board the New Jersey Chamber of Commerce's chartered Amtrak train to D.C.

- 2018-03-06

- The Star-Ledger

The Hudson River tunnels will undoubtedly fail, but it isn't likely to be a disaster-film spectacle.

They are currently dying from something more insidious, like gum disease - gradual, irreversible, yet no less fatal than a catastrophic incident - or something that will creep its way across the tableau like a blob that has come to asphyxiate the Northeast Corridor.

This is irrefutable: The 108-year-old train tunnels, decaying from the inside, need to be repaired and replaced, because once they fail, the consequences will reverberate throughout the land like an economic earthquake.